The Central Bank of Kenya on Friday, February 9, announced that the Kenyan shilling was expected to continue stabilising in February and March this year.

According to CBK, the stability was attributed to favourable diaspora remittances, a recovering agriculture sector, and a recovering tourism industry.

The improvement was also attributed to inflows from foreign investors who have shown interest in buying government infrastructure bonds and a slowing importer demand for hard currency.

As of Friday, February 9, the commercial banks quoted the shilling at 159 units against the dollar, compared with Thursday’s closing rate of 160 units, exhibiting a significant improvement.

The government has laid down measures to strengthen the Kenya Shillings against the US dollar in consistent with the macro-economic fundamentals.

- According to Central Bank of Kenya’s Indicative Exchange Rates, the shilling is at 160.3 against US dollar.

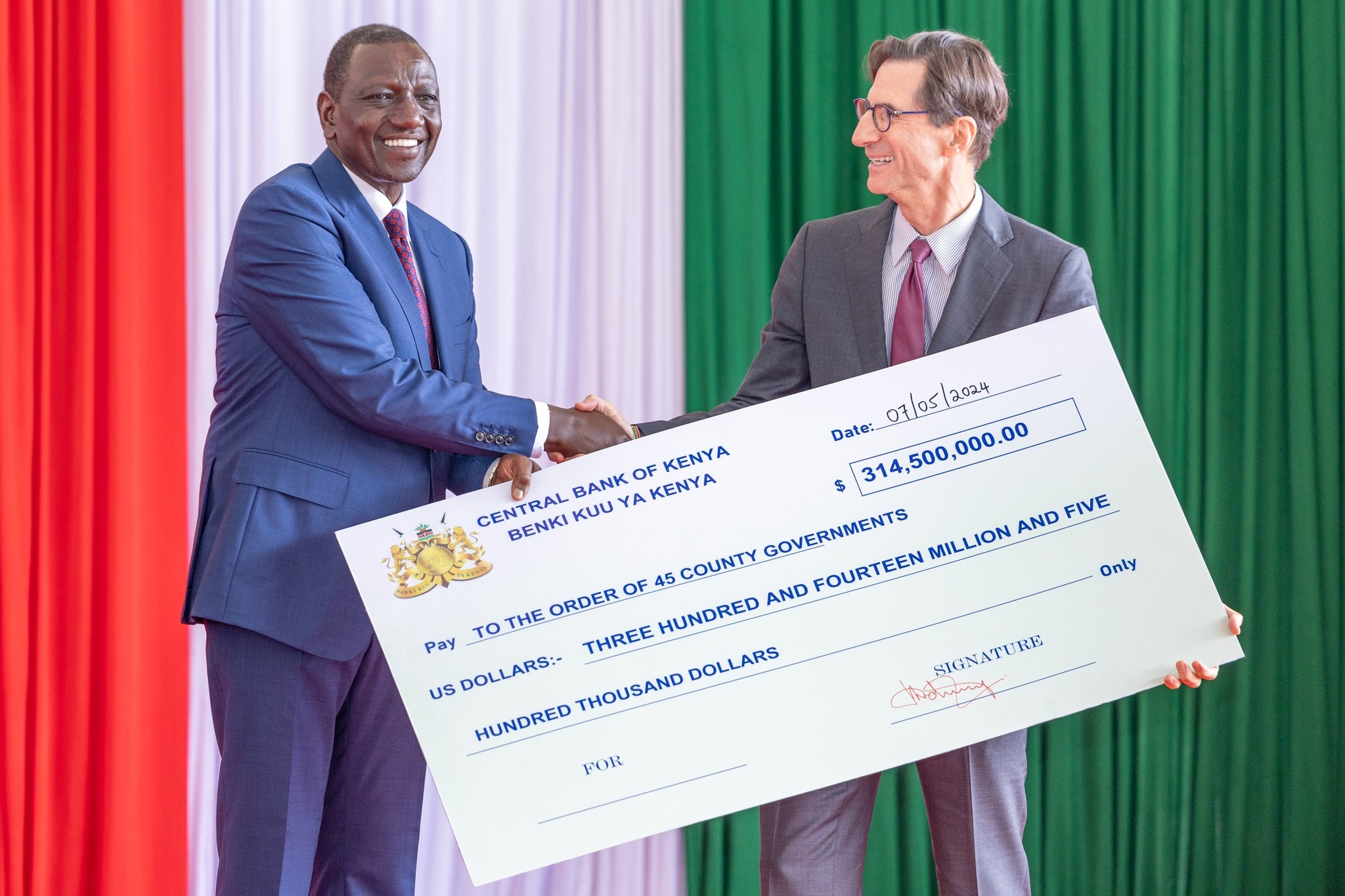

- Central Bank of Kenya (CBK) Governor Kamau Thugge said the government has appointed lead advisors for access of loan from the international market

- Multilateral lenders have continued pumping money into the economy which is expected to stabilize the shilling.