It’s been one year since the HustlerFund was launched at the Green Park terminus.

A lot of water has passed under the bridge and it’s amazing how time flies, indeed.

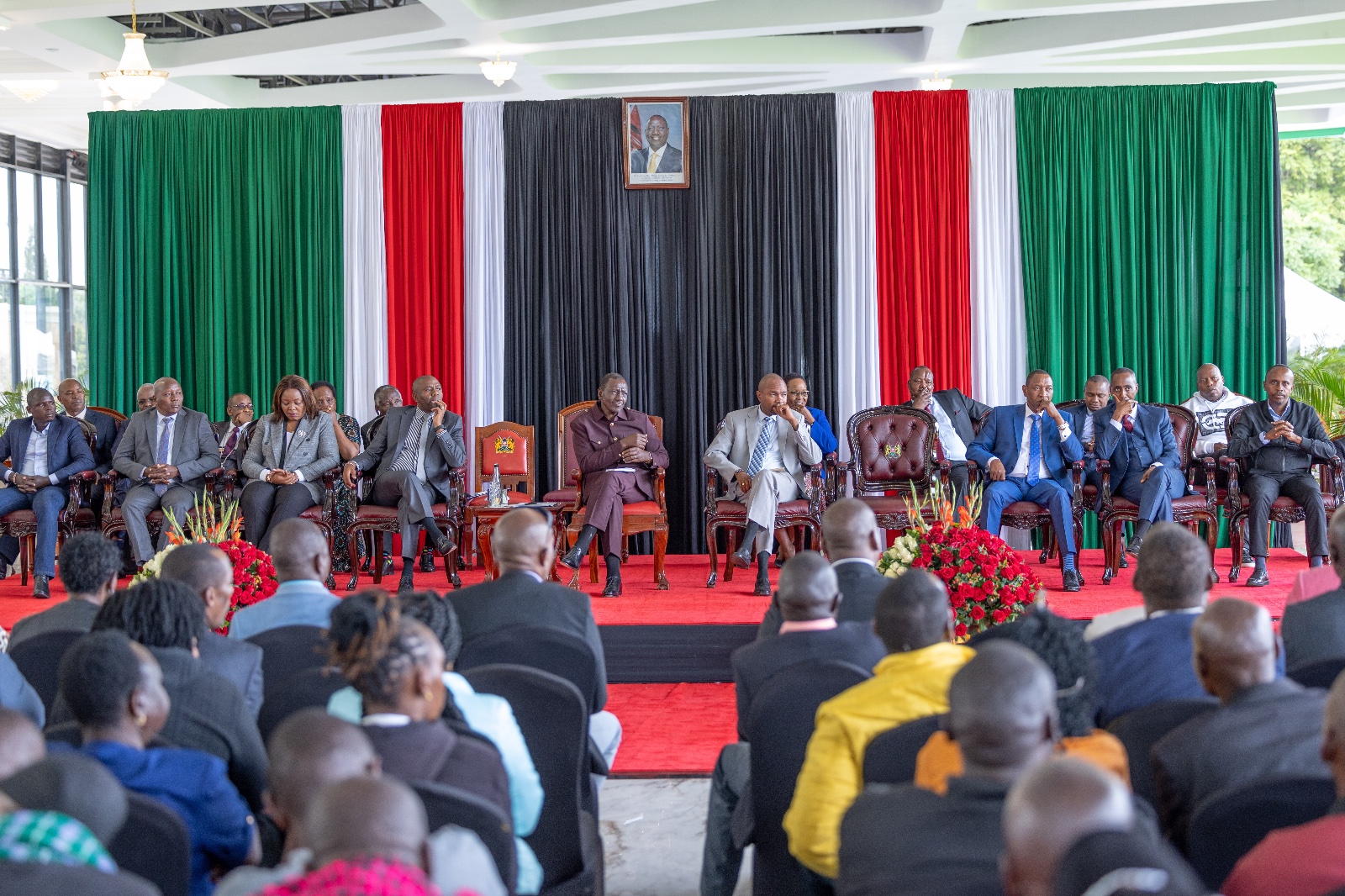

I remember vividly how President William Ruto gave a passionate speech as he delivered a key campaign promise that had resonated deeply with many Kenyans, everywhere he went.

This was the one clarion call that united the people at the bottom of the pyramid; they too could rise up and make something out of themselves.

The idea of the HustlerFund was born of the cry of Mama Mboga across the country, like the one who told then-Deputy President Ruto she is forced to borrow a little money at a high-interest rate, with payback in a day or two.

The interest was as high as 3,200 per cent, thus caging many hustlers in a poverty trap that has run for generations on end.

Such a rigged financial system cannot, therefore, enable budding entrepreneurs to make enough profit as it’s not only predatory but also had led to a culture in which those who fell off the formal financial architecture, could only end up at a shylock if only to get capital.

This was the one clarion call that united the people at the bottom of the pyramid; they too could rise up and make something out of themselves.

The idea of the HustlerFund was born of the cry of Mama Mboga across the country, like the one who told then-Deputy President Ruto she is forced to borrow a little money at a high-interest rate, with payback in a day or two.

The interest was as high as 3,200 per cent, thus caging many hustlers in a poverty trap that has run for generations on end.

Such a rigged financial system cannot, therefore, enable budding entrepreneurs to make enough profit as it’s not only predatory but also had led to a culture in which those who fell off the formal financial architecture, could only end up at a shylock if only to get capital.

Their profit was not meaningful to their investment, despite their hard labour. I remember coming across a lady by the name of Jane who had borrowed Sh700. She then got Sh635 from this and was to repay the money after 14 days. By the time the loan was due, she had made twice the amount on top of her savings, from her fruit and juice vending business in Kiserian.

I met her at a wedding in Thika, looking smartly dressed and happy. Jane’s story is replicated in so many other places across the country, and it’s comforting to note there are many such unsung heroes and heroines of our new financial inclusion model that have won accolades far and wide.

Heretofore, only about Sh12 billion was available to the special interest groups, namely the youth, women and people with disabilities to borrow from platforms such as the Youth Enterprise Development Fund, Women’s Enterprise Fund and the Uwezo fund.

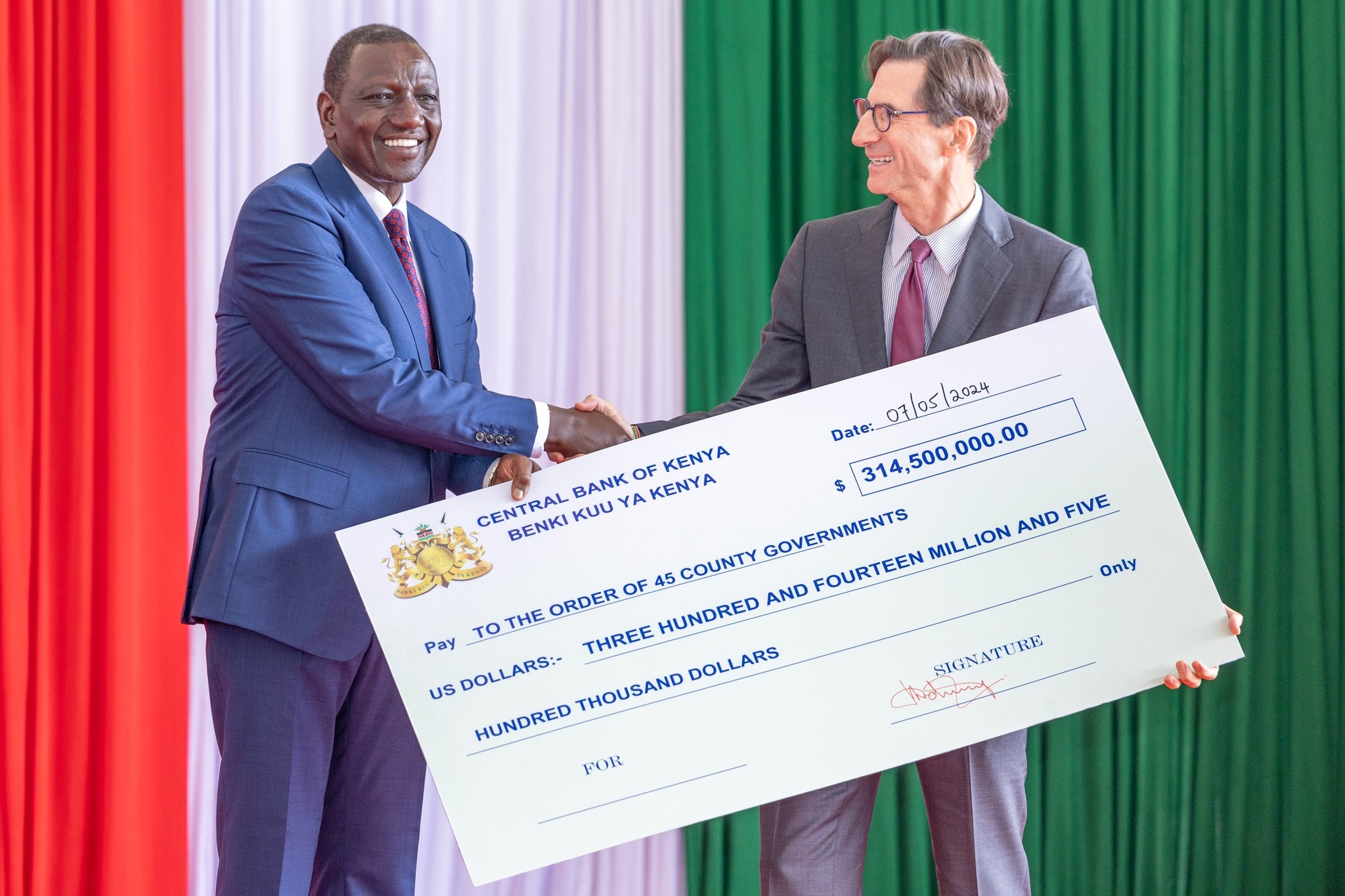

The one-year-old HustlerFund has already lent more than 39.5 billion shillings to Kenyans, making it the single largest fund any government has ever availed to Kenyans in 12 months, in our 60-year-long history since Independence.

They say that good things come in small packages. These micro-loans have been so transformational that more than 21.7 million Kenyans have already benefited from the HustlerFund.

This translates to 43.4 per cent of the estimated Kenyan population of 50 million today.

It also means most Kenyans who are adults have also been able to access the fund at some point in time in the last year.

This game changer is also anchored on the principle of a Kadogo economy since most households depend on this daily subsistence model for survival. For example, more than 9 million Kenyans rely on one token a day for their electricity needs.

This means the HustlerFund has a credit facility charging interest of about 0.002 per cent per day and thus is a very attractive source of capital to spend about Sh25 for power, as it is within the conceivable and projected daily profit margins.

It is encouraging the HustlerFund has also had repeat customers, more than 7.5 million Kenyans.

This means the fund has become a reliable source of finance for so many of us. Considering there are about 8 million daily hustle businesses within the informal economy, a lot of such businesses are relying on the fund to infuse liquidity into their businesses. It’s noteworthy that most such businesses are unstructured and thus cannot keep manual records; however, the digital nature of the HustlerFund enables them to have the records automatically.

M-Pesa has gained more than 2 million new customers due to the HustlerFund alone. This means that more Kenyans have been included in the formal financial system that avenues such as the banks haven’t been able to gain.

Amazingly, more than 2 billion shillings have been saved by Kenyans under this fund.

This means there is an increase in the savings culture that is critical if the country can generate resources from within its populace for other forms of investments.

Kenyans have been saving only 7 per cent of our GDP, compared to countries such as China that have a culture of saving as much as 55 per cent of their income, hence, the reason we have borrowed heavily from them to finance our development, of course, at a premium.

The transformation is real, considering that the top borrower from this fund has already accessed more than Sh4.5 million, and being a tuk-tuk operator, he has also been able to save more than Sh634,000.

This fund is thus leapfrogging our development as a nation in many, many little ways whose impact is most felt at the grassroots, the bottom whose upward mobility is not only critical but profound to the advancement of our nation towards a true middle-income economy.

Happy Birthday, HustlerFund!

The writer is the government spokesperson