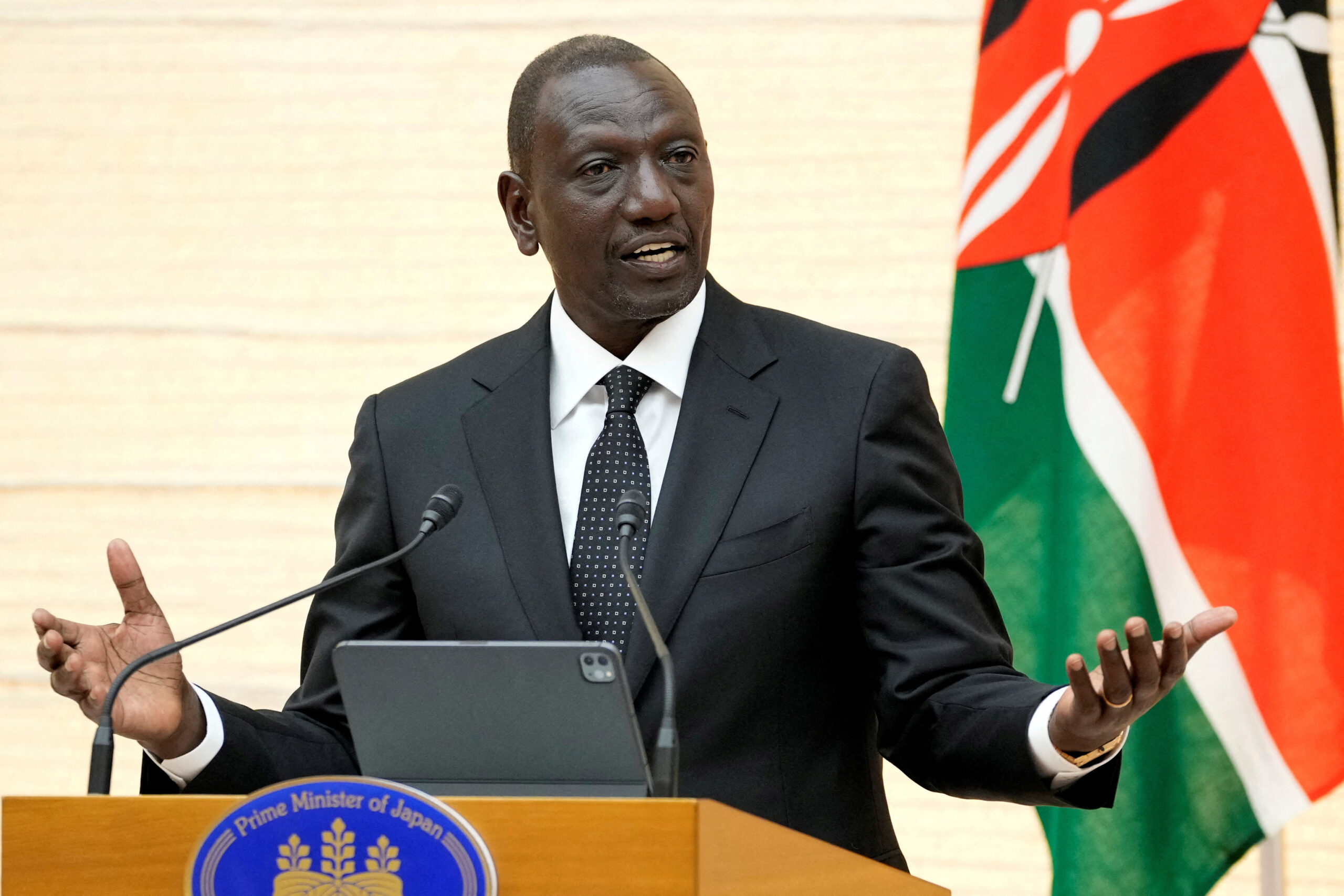

The government plans to collect an additional Sh323.5 billion in taxes, in a budget spending plan that will see the William Ruto-led administration spend a total of Sh4.55 trillion, mostly on salaries and debt repayments.

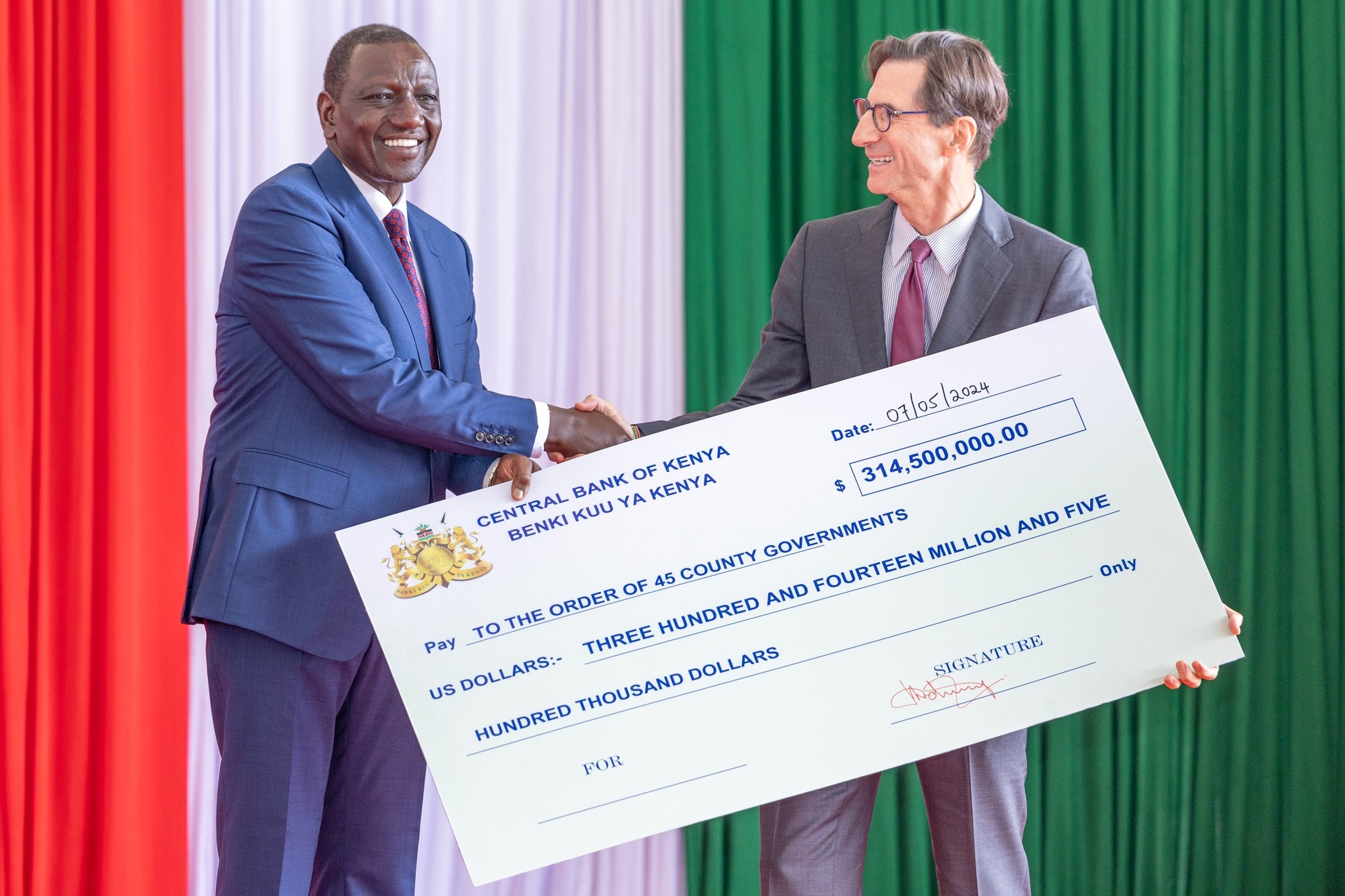

In the 2024 Budget Policy Statement (BPS), the government targets to collect Sh2.95 trillion in taxes in the fiscal year 2024/25 (July to June), relying on the proposed far-reaching tax measures that target the hard-to-tax sectors such as the informal, digital and agricultural activities.

In the current fiscal year ending June this year, the Kenya Revenue Authority (KRA) has been tasked with collecting Sh2.62 trillion from both direct and indirect taxes. These collections rely heavily on the revenue-raising measures contained in the Finance Act 2023, including the doubling of the value-added tax (VAT) on fuel.

Already, the KRA has missed its target for the first six months by Sh186.2 billion, with income taxes paid by corporations and employees contributing the most to this shortfall, a Treasury document shows.