Kenya’s Cabinet Despatch for Feb 14th, 2024 looks to piggyback on the high tide stemming from the US$1.5 billion Eurobond raise and signal a path back to fiscal consolidation.

In a statement on Wednesday, the Cabinet indicates that Budget Policy Statement 2024 and Budget 2024/25 will be anchored on austerity measures underpinned by the rationalization of non-priority expenditure ·

The Cabinet has also considered and approved proposed amendments to the Public Finance Management Act.

The mention of austerity indicates it is likely that marginal downward revision of 2024/25 expenditure captured in BROP has been deemed to be insufficient.

Here’s the latest we have seen on 2024/25 spending: ·

Expenditure was revised downward marginally from Kes 4.257 trillion to Kes 4.199 trillion.

Revenue projection was revised upward from Kes 3.408 trillion to Kes 3.455 trillion. Of this amount, Kes 2.958 trillion is ordinary revenue (enhanced from Kes 2.919 trillion in BROP).

External borrowing was revised upward to Kes 326.2 billion from Kes 297.0 billion.

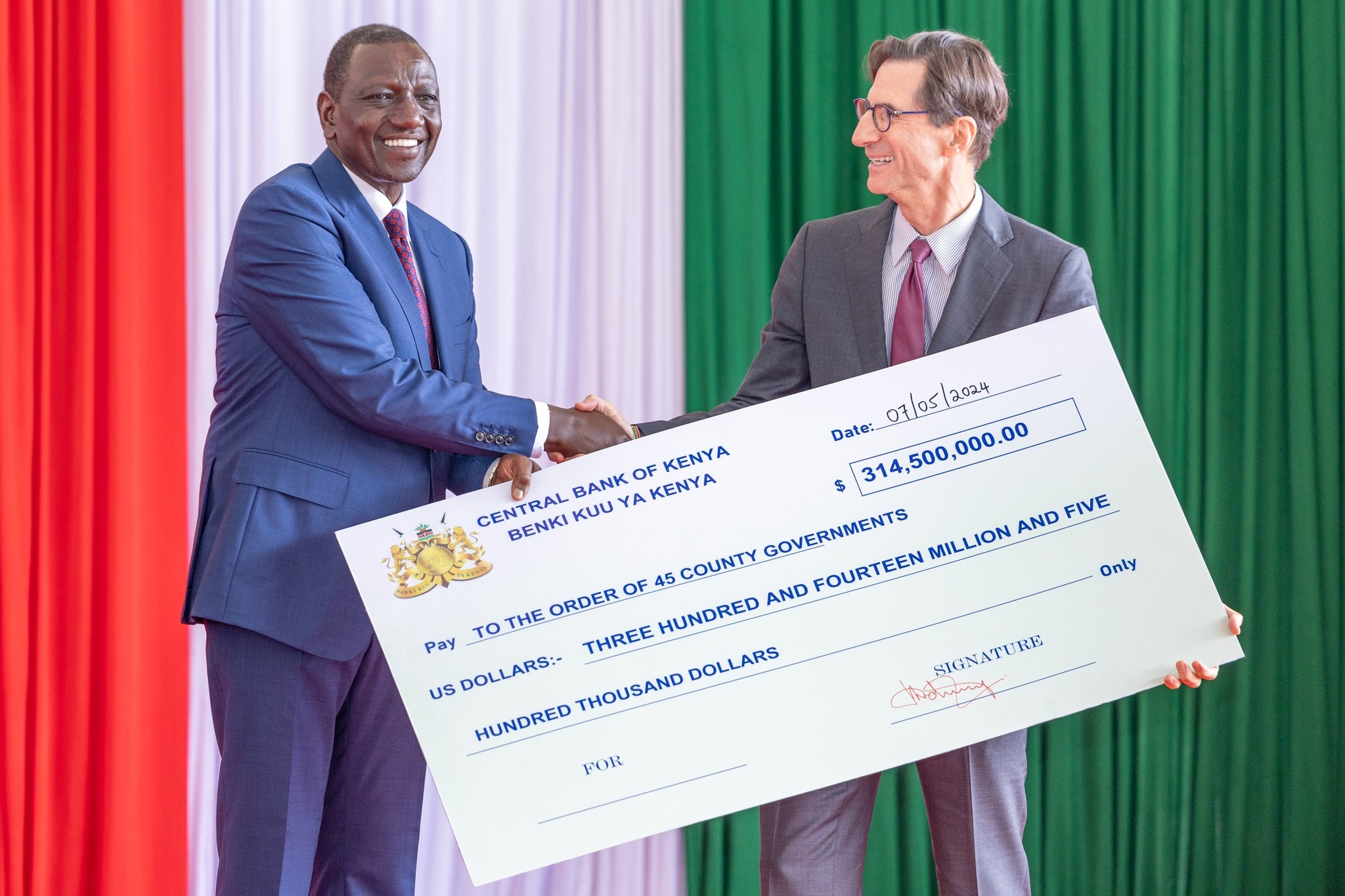

Domestic borrowing was downgraded from Kes 499.0 billion to Kes 377.4 billion. The fiscal deficit was revised downward from 4.4% of GDP to 3.9%. Allocation to counties is projected at Kes 438.9 billion (14.0% increase y/y).

Another major highlight from today’s Cabinet despatch is the revisiting of the divestiture of GOK’s stake from enterprises. Coming off the Jan 17th 6th review by the IMF’s board, this is a signal by GOK around commitment to meeting the benchmarks set ahead of the 7th review.

The cabinet considered and approved the proposed privatisation of the Development Bank of Kenya (DBK). Other divestitures are also lined up including – Kenya Safari Lodges and Hotels Ltd, Golf Hotel Ltd, Sunset Hotel Ltd, Mt. Elgon Lodge Ltd & Kabarnet Hotel Ltd.